As well as featuring great costs on a wide array of financial loan quantities, PenFed also has a robust discounted application providing cost savings on H&R Block tax preparing, university preparing services, coverage, plus much more.

An unsecured private loan is a standard-purpose installment personal loan. In contrast to auto loans or mortgages, a personal bank loan can be employed for just about anything. A personal mortgage is compensated out in one lump sum after your application is permitted, generally by using a bank deposit or even a Examine mailed for your tackle. At the time your personal financial loan resources are disbursed, you’ll make a similar set regular monthly payment for your lifetime of the loan, usually a few years in size.

Find lenders that think about more than simply your credit history. Lenders whose assessments of your respective creditworthiness aren’t entirely dependent on your FICO Score could be simpler to qualify with. As an illustration, some lenders may well keep in mind your profits, employment and training amount.

As opposed to sharing data with multiple lenders, complete just one uncomplicated, secure sort in 5 minutes or a lot less.

Highly-priced repayments. Payday financial loans can need repayment within a couple of weeks or a month. This may be hard to manage for those who don’t contain the revenue to include the cost. And when you roll around your repayment, you’re usually charged a further charge.

If you have bad credit history and need money immediately, then a payday personal loan could possibly be an option for you. Though lots of payday lenders don’t have stringent credit score requirements — and many don’t even Look at your credit — these loans could possibly get pricey. You are able to read through more details on a certain lender by picking Browse Assessment or Head over to internet site.

Own financial loans are typically unsecured, meaning They may be supported by your creditworthiness as opposed to collateral. Collateral is definitely an asset, like a motor vehicle or household, a lender might use to recoup its losses if you default with a secured financial loan.

A home equity line of credit score (HELOC) functions likewise to a bank card; buyers can borrow around they require (as many as a Restrict) against their house’s equity and only have to pay again the amount they took out. As opposed to household equity financial loans, HELOCs click here usually have variable desire premiums.

Use our personal bank loan calculator to zero in over a bank loan volume and term that matches your credit score, your monetary record, and your price range. It is possible to see how long It's going to just take you to pay down your bank loan—plus your bank loan's whole Charge—with different amounts, rates, and credit history amounts.

No joint programs obtainable Financial loans can only be employed towards paying off bank cards Funding timeline can be gradual Why we like it

Quite a few on the internet lenders assure rapidly funding, with money deposited into your checking account in as little as one or two company times in case you’re accepted.

Deliver the email deal with in which you prefer to to obtain your loan ask for affirmation. E mail deal with

*APR ranges for some firms include things like a discount for automatic payments or current financial institution buyers.

Marcus by Goldman Sachs regularly earns acclaim for its aggressive desire charges, clear phrases, and Extraordinary customer support.

Mara Wilson Then & Now!

Mara Wilson Then & Now! Bradley Pierce Then & Now!

Bradley Pierce Then & Now! Joseph Mazzello Then & Now!

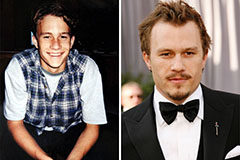

Joseph Mazzello Then & Now! Heath Ledger Then & Now!

Heath Ledger Then & Now! Kenan Thompson Then & Now!

Kenan Thompson Then & Now!